IT F24 2004-2026 free printable template

Show details

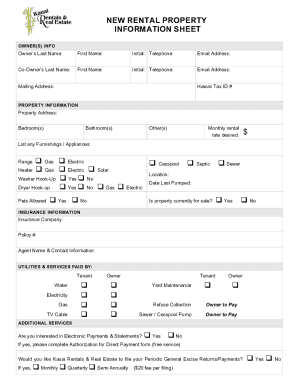

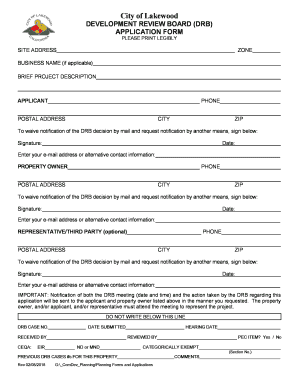

Mod. AGENZIA DELLE ENTRATE MODELLO DI PAGAMENTO UNIFICATO F24 predeterminato DELEGA IRREVOCABILE A AGENZIA PER L ACCREDITO ALLA TESORERIA COMPETENTE CONTRIBUENTE PROV. Codice fiscale cognome denominazione o ragione sociale nome Dati riservati all ufficio MOTIVO DEL PAGAMENTO Ravv* codice comune Immob. variati Acc* Saldo numero immobili codice tributo anno di riferimento importi a debito versati detrazione ICI abitazione principale Istruzioni per il versamento ICI o pi immobili che richiedano...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign modello f24 predeterminato pdf form

Edit your f24 form italy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your f24 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit f24 predeterminato online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit modello f24 form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form f24

How to fill out IT F24

01

Obtain the IT F24 form from the official tax agency website or at designated offices.

02

Fill in your personal information including name, address, and tax identification number.

03

Select the appropriate payment type (tax, fees, contributions) from the provided options.

04

Enter the amount to be paid in the corresponding section.

05

Complete any additional sections related to specific tax codes or periods as necessary.

06

Review the form for accuracy and completeness.

07

Submit the form online, via bank, or at a post office, depending on the payment method chosen.

Who needs IT F24?

01

Individuals who are required to pay taxes or contributions to the Italian government.

02

Self-employed individuals or freelancers.

03

Entities with taxable income or those who need to make tax payments on behalf of others.

04

Companies and businesses operating in Italy.

Fill

f24 modificabile

: Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit modello di pagamento unificato in english in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing f24 predeterminato editabile and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How can I edit f24 online on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit f24 online download.

Can I edit f24 italy on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign f24 editabile semplificato right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

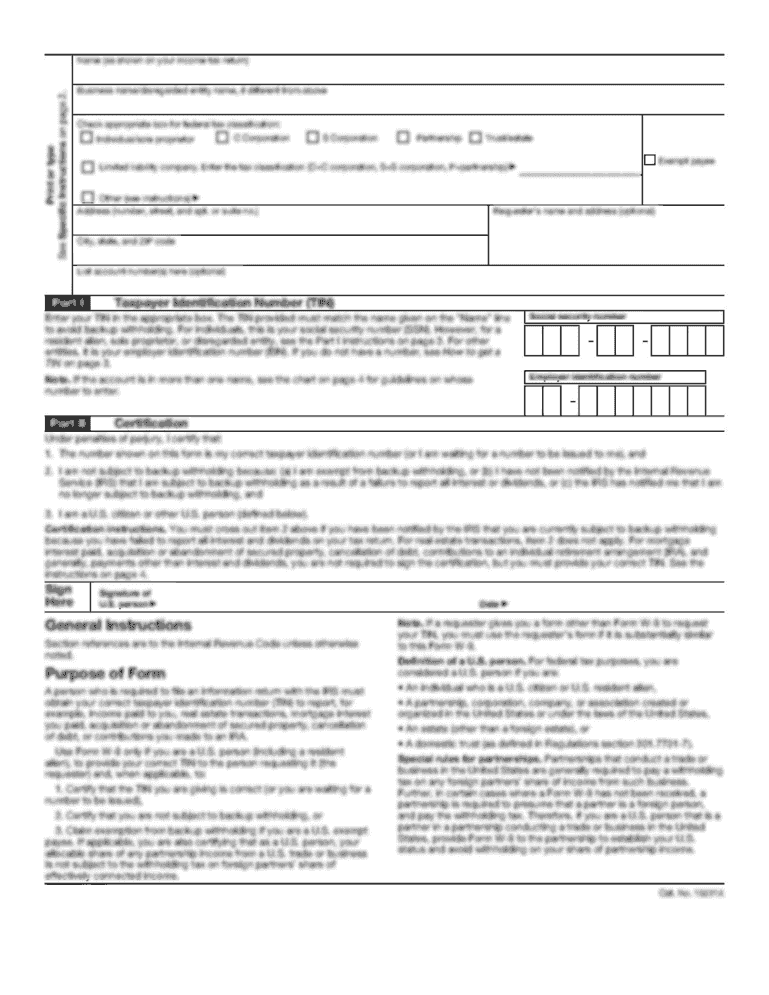

What is IT F24?

IT F24 is a tax form used in Italy for the payment of taxes and contributions. It allows taxpayers to make payments for various tax obligations in a single transaction.

Who is required to file IT F24?

Individuals and businesses in Italy who need to pay taxes, including income tax, value-added tax (VAT), and social contributions, are required to file IT F24.

How to fill out IT F24?

To fill out IT F24, taxpayers need to provide their personal information, including tax identification number, payment details, and the applicable tax codes corresponding to the taxes being paid.

What is the purpose of IT F24?

The purpose of IT F24 is to facilitate the payment of various taxes and social contributions, consolidating multiple tax payments into a single form for convenience.

What information must be reported on IT F24?

Information that must be reported on IT F24 includes the taxpayer's identification details, payment amounts, the relevant tax codes, and the periods for which the payments are being made.

Fill out your IT F24 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mod f24 Predeterminato is not the form you're looking for?Search for another form here.

Keywords relevant to f24 pdf

Related to f24 in bianco

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.